dealermobil.site

Learn

Model Of Customer Relationship Management

Customer relationship management (CRM) is a process in which a business or other organization administers its interactions with customers, typically using. With CRM software, organizations can effectively manage and maintain client relationships. A CRM strategy is a plan that outlines how a business will serve and. Top 4 CRM Models for Boosting Customer Loyalty and Profitability · 1. IDIC Model · 2. QCI Model · 3. Payne's Five Process Model · 4. CRM Value Chain. The intention of CRM is to maintain these business relationships with customers to keep customer satisfaction rates high and to give them a reason to come back. This capability maturity model can be used to measure the maturity of an organization's customer relationship management process and to assist its progress. The Value Chain model divides CRM activities into primary stages like customer analysis and secondary supporting conditions. The QCI model shows a series of. Explore CRM models to streamline your business processes. Discover efficient strategies and tools for better customer relationship management. (Kamakura et al., ) highlights that Customer Relationship Management (CRM) ordinarily includes following personal client behaviour over time, and. CRM (customer relationship management) is the combination of practices, strategies and technologies that companies use to manage and analyze customer. Customer relationship management (CRM) is a process in which a business or other organization administers its interactions with customers, typically using. With CRM software, organizations can effectively manage and maintain client relationships. A CRM strategy is a plan that outlines how a business will serve and. Top 4 CRM Models for Boosting Customer Loyalty and Profitability · 1. IDIC Model · 2. QCI Model · 3. Payne's Five Process Model · 4. CRM Value Chain. The intention of CRM is to maintain these business relationships with customers to keep customer satisfaction rates high and to give them a reason to come back. This capability maturity model can be used to measure the maturity of an organization's customer relationship management process and to assist its progress. The Value Chain model divides CRM activities into primary stages like customer analysis and secondary supporting conditions. The QCI model shows a series of. Explore CRM models to streamline your business processes. Discover efficient strategies and tools for better customer relationship management. (Kamakura et al., ) highlights that Customer Relationship Management (CRM) ordinarily includes following personal client behaviour over time, and. CRM (customer relationship management) is the combination of practices, strategies and technologies that companies use to manage and analyze customer.

CRM, or customer relationship management, is a process of courting and connecting with users using consumer data. Ultimately, IDIC models work to improve your. Customer relationship management (CRM) is software for organizing, maintaining, and retrieving relevant customer information in real time. Buttle's book is a comprehensive coverage of CRM, without the bias of a particular "magic bullet" solution to push. The author covers several models of CRM. A CRM marketing strategy uses customer data to create personalized marketing campaigns. It aims to improve customer engagement, retention, and loyalty. Customer relationship models seek to acquire, develop and retain customers. Small businesses must remain vigilant when it comes to managing customer data and. CRM stands for customer relationship management. A key element of customer relationship management is to learn as much as possible about customers (within. CRM (customer relationship management) is a strategy that organizations use to improve customer satisfaction and loyalty. Businesses can better understand. Customer relationship management (CRM) includes the principles, practices, and guidelines that an organization follows when interacting with its customers. · CRM. Customer relationship management (CRM) is a process for collecting, maintaining and updating information about customers and prospective customers. A CRM system. Models of CRM: · 1. IDIC Model. Developed by Peppers and Rogers -a consultancy firm. · 2. QCi Model. Developed by Woodcock, Stone and Foss -. CRM stands for customer relationship management, which is a system for managing all of your company's interactions with current and potential customers. A Customer Relationship Management (CRM) system helps manage customer data. It supports sales management, delivers actionable insights, integrates with. Customer relationship management (CRM) is a complete software system that manages customer relationships, but it isn't a single solution. CRM helps organizations optimize their relationships with their customers. That allows you to work towards a specific customer value proposition that can be. Customer relationship management (CRM) is a business strategy that optimizes revenue and profitability while promoting customer satisfaction and loyalty. Modern CRM theory refers to the idea of 'integrating the customer'. This new way of looking at the business involves integrating the customer (more precisely. Customer Relationship Management is the establishment, development, maintenance and optimisation of long-term mutually valuable relationships between consumers. Customer relationship management (CRM) is a strategy for managing relationships with customers in an organized way. Organizations use CRM to learn more about. The IDIC (identify, differentiate, interact, customise) is a model developed by Peppers & Rogers (). The model helps to assess the. Often built around complex software packages, these customer relationship management (CRM) systems promised to allow companies to respond efficiently, and at.

Quick Life Insurance Calculator

Our life insurance calculator lets you compare different scenarios to calculate the death benefit amount that suits your life and priorities. Calculated. A simple calculator to help you find out how much life insurance you might need. Get Started. The following life insurance calculator and tools will help you decide how much life insurance you may need and the potential costs. Haven Life offers an easy way to buy high-quality, affordable term life insurance online. Get your real rate today. Whether you need short-term coverage while between jobs, or want to give your family long-term financial security, Progressive Life Insurance by eFinancial has. How you can benefit from TD Term Life insurance · Get a No Obligation Quote You can get a quote in 60 seconds with no need to provide any contact information and. Answer a few questions about you and your life, and we'll give you an estimate of how much coverage you might need and about how much it could cost. For a quick comparison, utilize tools like a life insurance policy calculator to check quotes. Term life insurance calculators are usually readily available. MassMutual's Life Insurance Calculator provides you with a quick and easy estimate of how much life insurance coverage you may need. Our life insurance calculator lets you compare different scenarios to calculate the death benefit amount that suits your life and priorities. Calculated. A simple calculator to help you find out how much life insurance you might need. Get Started. The following life insurance calculator and tools will help you decide how much life insurance you may need and the potential costs. Haven Life offers an easy way to buy high-quality, affordable term life insurance online. Get your real rate today. Whether you need short-term coverage while between jobs, or want to give your family long-term financial security, Progressive Life Insurance by eFinancial has. How you can benefit from TD Term Life insurance · Get a No Obligation Quote You can get a quote in 60 seconds with no need to provide any contact information and. Answer a few questions about you and your life, and we'll give you an estimate of how much coverage you might need and about how much it could cost. For a quick comparison, utilize tools like a life insurance policy calculator to check quotes. Term life insurance calculators are usually readily available. MassMutual's Life Insurance Calculator provides you with a quick and easy estimate of how much life insurance coverage you may need.

This tool helps you get a fast estimate on how much life insurance you should apply for to help cover your family's needs. How much life insurance do you need? Use the Thrivent Life Insurance Calculator to get a quick & easy estimate. A life insurance policy pays out a sum of money to your loved ones when you die. Learn more and compare life insurance quotes before you buy. Input your liabilities and subtract your assets to estimate how much life insurance protection you need with TruStage's free life insurance calculator. Take our quick 8-question assessment for an approximate coverage level you'd need to care for your loved ones, help protect the things you value, and help meet. Calculate how much life insurance you might need to protect the people if you die. Complete this quick assessment now. Our life insurance calculator is the easiest way to estimate your life insurance costs and how much cover you may need based on your current situation. Our life insurance calculator draws on important factors to calculate an estimate, including your age, gender, relationship status, and dependents. Use our whole life insurance calculator to: ✓Fill out our online form Quick Quote or Detailed Analysis. Know how much insurance you need? Great, go. Term life insurance helps protect the financial future of Canadian families. Term insurance is very affordable and easy to buy online. Calculate your life. Use the USAA life insurance calculator to estimate how much coverage you should have. Answer a few questions, and we will provide your life insurance needs. Our life insurance calculator draws on important factors to calculate an estimate, including your age, gender, relationship status, and dependents. Calculate the life insurance coverage and term length you need - get a quote and help protect your family with term life insurance. Get Life Insurance Quote. Get a life insurance quote. Request a quick quote for the protection you need. Protect what matters most. Scotia Accidental Death. Life insurance term quotes North American's term life insurance helps provide protection when your family may need it most. Whether you've recently married. Quick Term Life Insurance Calculator. Find out how much term life insurance you need. We'll do the math! How much term life insurance do you need? Individual. MassMutual's Life Insurance Calculator provides you with a quick and easy estimate of how much life insurance coverage you may need. In short, if there are people who rely on you for financial support, having life insurance is a way to make sure they're taken care of if something unexpected. Adjust your level of coverage to align with your needs, identify the right type of policy for you, and get immediate price quotes* with our quick & easy life. Our life insurance calculator provides the simplest way to calculate how much life cover you may need. Find out more about our life insurance here.

Relationship Between Bonds And Interest Rates

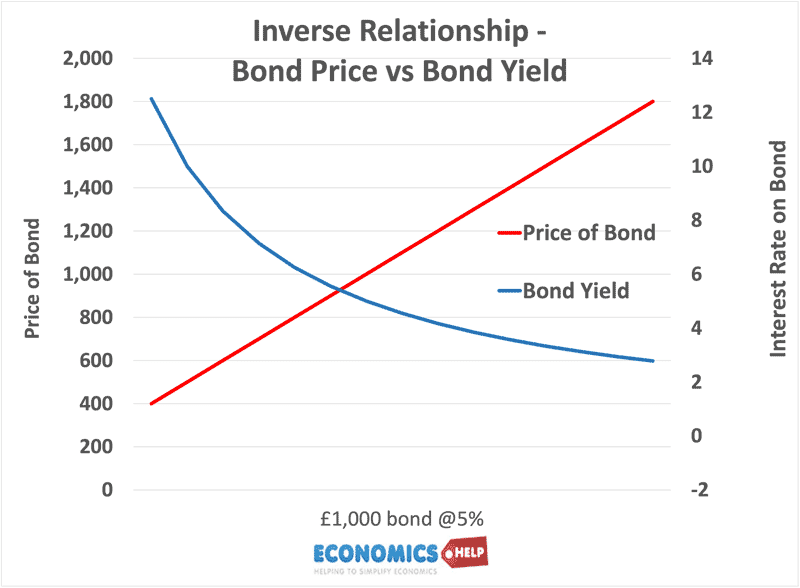

Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest. Relationship Between Market Interest Rates and a Bond's Market Value · When market interest rates increase, the market value of an existing bond decreases. · When. Bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates go. Inflation erodes the value of any promise to pay a fixed sum in the future, including interest payments on a bond or loan. Investors and lenders demand. The seesaw effect between interest rates and bond prices applies to all bonds, even to those that are insured or guaranteed by the u.s. government. The reverse also applies. This inverse relationship between interest rates/yields and prices is the reason why fixed income portfolio managers take great pains. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. Bonds and interest rates: an inverse relationship. All else being equal, if new bonds are issued with a higher interest rate than those currently on the market. The difference between the face value and the discounted price you pay is "interest. Like bonds and notes, the price and interest rate are determined at the. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest. Relationship Between Market Interest Rates and a Bond's Market Value · When market interest rates increase, the market value of an existing bond decreases. · When. Bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates go. Inflation erodes the value of any promise to pay a fixed sum in the future, including interest payments on a bond or loan. Investors and lenders demand. The seesaw effect between interest rates and bond prices applies to all bonds, even to those that are insured or guaranteed by the u.s. government. The reverse also applies. This inverse relationship between interest rates/yields and prices is the reason why fixed income portfolio managers take great pains. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. Bonds and interest rates: an inverse relationship. All else being equal, if new bonds are issued with a higher interest rate than those currently on the market. The difference between the face value and the discounted price you pay is "interest. Like bonds and notes, the price and interest rate are determined at the.

Both bond prices and yields go up and down, but there's an important rule to remember about the relationship between the two: They move in opposite directions. Hence if the market expects interest rates to rise, then bond yields rise as well, forcing bond prices, in turn, to fall. The reverse also applies. This inverse. If the bond price is greater than the face value, the interest rate is greater than YTM. If the bond price is less than the face value, the interest rate is. A yield curve (which can also be known as the term structure of interest rates) represents the relationship between market remuneration (interest) rates and the. Bond prices have an inverse relationship with interest rates. This means that when interest rates go up, bond prices go down and when interest rates go down. When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant, and yields go up. Bond prices move inversely to changes in interest rates, so that if interest rates rise (or fall), bond prices fall (or rise). The longer a bond's duration. Bond prices move inversely to changes in interest rates, so that if interest rates rise (or fall), bond prices fall (or rise). The longer a bond's duration. When rates increase, the value of bonds decrease in order to provide the buyer of the bond an acceptable yield. Most investors recognize that there is a relationship between interest rates and bond prices. At their most simple level, bonds are simply loans that the. Banks usually lend for longer terms than they borrow so part of this profit comes from the difference between long-term and short-term interest rates (i.e. the. Important point: Bond price & interest have convex relationship. Meaning - A 5% increase in internet rate would increase the bond price by more. Your return on a bond is not just about its price. · When interest rates are rising, you can purchase new bonds at higher yields. · Over time the portfolio earns. What is the Relationship between. Duration and Bond Price? The price and yield (the income return on an investment) of a bond generally have an inverse. The Bottom Line: Understand The Relationship Between Bonds And Mortgage Rates. Bond prices have an inverse relationship with mortgage interest rates. As bond. The yield and bond price have an important but inverse relationship. When the bond price is lower than the face value, the bond yield is higher than the coupon. If they didn't need the money, they wouldn't be issuing bonds. Higher interest rates are to drive demand for the bonds. It sounds like you're. Concept Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM. A rise in either interest rates or the inflation rate will tend to cause bond prices to drop. Inflation and interest rates behave similarly to bond yields. Bond prices have an inverse correlation to interest rate movements, that is, if market rates increase after a bond issue, the price of these bonds declines.

What To Invest In To Make More Money

Your money is paid a low wage as it works for you. After paying off credit cards or other high interest debt, most smart investors put enough money in a savings. How much do I need to start investing? You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Minimize the downside risk of a huge investment. · Take advantage of the market's natural volatility by lowering the average price you pay for shares. · Avoid. Everyone invests to make money, but you can make money from your investments in two ways. The various conservative income options, for example, make regular. Keep more money in your portfolio with low-cost exchange-traded funds (ETFs) and our transparent pricing. Adjusts automatically. Your investments are. You can create a ladder by investing in a mix of bonds with short, medium and long durations. “Most income investors want regular, reliable payments, which. How do you want to invest your money? Select “Accept All Cookies” for a more optimized experience or select “Manage Cookie Settings” to make a change. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their. Your money is paid a low wage as it works for you. After paying off credit cards or other high interest debt, most smart investors put enough money in a savings. How much do I need to start investing? You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Minimize the downside risk of a huge investment. · Take advantage of the market's natural volatility by lowering the average price you pay for shares. · Avoid. Everyone invests to make money, but you can make money from your investments in two ways. The various conservative income options, for example, make regular. Keep more money in your portfolio with low-cost exchange-traded funds (ETFs) and our transparent pricing. Adjusts automatically. Your investments are. You can create a ladder by investing in a mix of bonds with short, medium and long durations. “Most income investors want regular, reliable payments, which. How do you want to invest your money? Select “Accept All Cookies” for a more optimized experience or select “Manage Cookie Settings” to make a change. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their.

A short-term investment, such as a U.S. Treasury bill or a money market mutual fund, that you can easily convert to cash. HOW YOU EARN RETURNS: Most cash. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. 20 Best Ways to Invest in Yourself · 1. TAKE RESPONSIBILITY FOR YOUR OWN LIFE. · 2. SET S.M.A.R.T. GOALS. · 3. LEARN HOW MONEY WORK. · 4. TAKE CARE OF YOUR PHYSICAL. 4 ways to find more money to invest in your future · Cut back on impulse purchases · Redirect cash-back rewards · Save spare change · Take on a side gig. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons Enhanced. Minimize the downside risk of a huge investment. · Take advantage of the market's natural volatility by lowering the average price you pay for shares. · Avoid. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. Earn money that can grow when you shop with brands that invest in you. Earn connects you with + top brands that add money to your Acorns account. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Invest in Stocks · Invest in Mutual Funds or Exchange-Traded Funds (ETFs) · Invest in Bonds · Use a Robo-Advisor for Automatic Investing · Invest in. You're not sure how you want to invest your money. You're looking to start You will earn an additional $ back for every $ (4% Cash Back. Choose your investments When your money hits your account, it will be automatically deposited as either cash (in a brokerage account, you might see something. Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in. 1. Take out a loan or line of credit · how much you borrow · what kind of loanLoan An agreement to borrow money for a set period of time. You agree to pay · the. If you know you are going to need your money in three to five years, consider investing it in the stock market — but more conservatively. “You want to keep at. This is not inclusive of the clean energy tax incentives from the Inflation Reduction Act. $Bannounced to make our communities more resilient to climate. more money than you put in. If you have savings available, and are interested in learning more about investing opportunities, talk with a TD personal banker. Share your space · Write an e-book · Become a fitness or health coach · Review resumes · Start freelancing · Start a blog · Invest in real estate · Become a peer-to-.

How Much Does A Cash Out Refinance Cost

The calculator will provide assumptions for the cash-out refinance interest rate, loan term, and estimated closing costs. It does not originate mortgages for. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount —. How much is the VA funding fee for a cash-out refinance? However, many homeowners with FHA mortgages will choose to refinance to a conventional mortgage to eliminate the cost of the mortgage insurance required with. The cash out refinance rate we may be able to offer you depends on your credit score, income, finances, the current mortgage rate market, and other factors. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. By taking cash out of your home, the home loan balance increases while the home's value does not. This results in a higher loan-to-value ratio and lowers the. Get the cash you need without resetting your existing mortgage term and interest rate · Lower closing costs and fees, in most cases, compared to a mortgage cash-. The calculator will provide assumptions for the cash-out refinance interest rate, loan term, and estimated closing costs. It does not originate mortgages for. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. As with any mortgage refinance, you'll pay closing costs for a cash-out refinance. Closing costs typically range from 2% to 5% of the total mortgage amount —. How much is the VA funding fee for a cash-out refinance? However, many homeowners with FHA mortgages will choose to refinance to a conventional mortgage to eliminate the cost of the mortgage insurance required with. The cash out refinance rate we may be able to offer you depends on your credit score, income, finances, the current mortgage rate market, and other factors. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. By taking cash out of your home, the home loan balance increases while the home's value does not. This results in a higher loan-to-value ratio and lowers the. Get the cash you need without resetting your existing mortgage term and interest rate · Lower closing costs and fees, in most cases, compared to a mortgage cash-.

Your actual cash-out amount may be less. It will be calculated by taking 80% of your property's actual value (as determined by a full appraisal) and subtracting. % higher for a cash out refinance depending on your credit score, loan-to-value (LTV) ratio and other factors. Lenders charge a higher interest rate because. A cash-out refinance could help you accomplish your financial goals without relying on personal loans or credit cards. Read how! Cash out refinancing occurs when a loan is taken out on property already owned in an amount above the cost of transaction, payoff of existing liens. Cash-out refinance closing costs: How much you'll pay. Refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. See how much you could borrow with a cash-out refinance. Loan Information rate. Closing costs. $0. By refinancing you'll receive $50, in cash with. Closing Costs (3%), $4,, $0* ; Interest Rate, %, % ; Monthly Payment, $1,, $1, ; Cost in first 24 months, $27,, $26, For example, Ian has a primary residence single-family home with a property value of $, and a current mortgage balance of $, His calculations would. How often do cash-out refinance rates change? Cash-out refinance rates change frequently — as often as every day, due to market conditions and other factors. So, for a loan of $,, you could expect to pay between $4, to $12, in closing costs. These costs can include lender fees, appraisal fees, and title. For example, Ian has a primary residence single-family home with a property value of $, and a current mortgage balance of $, His calculations would. You'll still owe closing costs, as you would with any VA loan, including the VA funding fee. But borrowers can always roll that expense into your monthly. Although a cash-out refinance has a higher upfront cost than a home equity mortgage, cash-out refinancing comes with lower out-of-pocket monthly payment. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. Closing costs will run you % of the new loan amount. A loan of $, would cost you between $3,$9, Shop around and don't settle for the first. Your Desired Mortgage Loan Closing costs are typically between % of the loan amount, but you can enter any number to compare costs. A cash-out refinance. Is a cash-out refinance right for me? A cash-out refinance could be a great option for you if: much better rates than credit cards and other types of debt. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. Get an estimate of how much cash you may be able to borrow from your home equity. A cash out refinance replaces your current mortgage for more than you. The Annual Percentage Rate is %. No prepayment penalty. Payment shown does not include taxes and insurance. The actual payment amount will be greater.

Best And Fastest Way To Build Credit

How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. If you do not want to commit to a credit card, there are other methods for establishing and building your credit score. Contact your utilities or loan companies. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. The Federal Trade Commission's “Building a Better. Credit Report” (dealermobil.site Understand how your credit score is determined. Your credit score is. “Kikoff is the best way to build credit quickly.” - Fredrika, a real Kikoff customer. day money back guarantee. We're. Build credit by using a credit card regularly, keeping a low balance, and always paying on time. August 30, Brian Yip. August 30, •. 7 min. Five Best Ways to Build Credit · 1. Pay on time, every time · 2. Lower your credit utilization rate · 3. Explore alternative lending options · 4. Review your credit. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. If you do not want to commit to a credit card, there are other methods for establishing and building your credit score. Contact your utilities or loan companies. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. The Federal Trade Commission's “Building a Better. Credit Report” (dealermobil.site Understand how your credit score is determined. Your credit score is. “Kikoff is the best way to build credit quickly.” - Fredrika, a real Kikoff customer. day money back guarantee. We're. Build credit by using a credit card regularly, keeping a low balance, and always paying on time. August 30, Brian Yip. August 30, •. 7 min. Five Best Ways to Build Credit · 1. Pay on time, every time · 2. Lower your credit utilization rate · 3. Explore alternative lending options · 4. Review your credit. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit.

Along with considering revolving credit in the form of credit cards, it's a good idea to add an installment loan or two to your credit mix. While revolving. Credit monitoring services. You must have a comprehensive understanding of your current financial situation before you can start effectively building credit. Reports to all 3 major credit bureaus · Access to your FICO® Score · Automatic payments · Free financial literacy education · Access to premium subscriptions · Cell. Creditors use these scores to quickly understand how risky lending money to the person could be. best credit cards to build credit fast. Fortunately, there. One way to start a credit history is to have one or two department store or gas station cards. They allow you to: Buy online or over the phone where cash may. A good credit score shows you've managed credit well in the past, such as repaying a loan or credit card on time. This means you're far more likely to qualify. This means having one or more credit accounts, borrowing money in that account, and then making payments on it. The key to building a good credit score is to. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. It usually takes a minimum of six months to generate your first credit score. Establishing good or excellent credit takes longer. Payment history is a very important factor in your credit score, so making payments on time is one of the best things you can do to build credit. Making timely. Another way to build credit is to become an authorized user on the credit card of a trusted family member or friend. While authorized users have access to an. Some ways to establish credit for the first time include: Become an authorized user; Try a credit-building debit card; Apply for a secured credit card; Apply. Simply having an open credit card account is the easiest way to build credit, and payment history is the biggest ingredient in your credit score. With that. Adding another element to the current mix helps your score as long as you make on-time payments. Quick Loan Shopping. If you have bad credit and can't find. 6. Debit Cards That Build Credit, No risk of late payments or high credit utilization, You may have to allocate money in advance to cover your purchases. 1. Become an Authorized User One way to build credit with no credit is to ask a family member or friend who has good credit to add you as an. Snapshot of Card Features · A whole new way to build credit: build your credit score without ever worrying about overspending. · No credit checks and no credit. Then take the money you've freed up and apply it to paying down your debt. Pay with cash. One way to manage. The Top 5 Things For Raising Your Credit Quickly · 1. Lower Your Credit Utilization Ratio · 2. Make Multiple Payments · 3. Avoid Hard Credit Pulls · 4. Ask For a. Having both revolving and installment credit makes for a perfect duo because the two demonstrate your ability to manage different types of debt. And experts.

Stock Charting Sites

In this article, we will walk you through the best platforms and websites for accessing top-notch, free stock charts. Interactive financial charts for analysis and generating trading ideas on TradingView! Our advanced charts offer a dynamic features like click & drag interaction, event indicators, and right-click interactivity. Our research shows TradingView is the best free stock charting analysis software, with indicators and charts for stocks, Forex, commodities, and ETFs. Moomoo boasts 38 drawing tools to help you identify trade signals faster, even using sophisticated charts The moomoo app is an online trading platform offered. ProRealTime Web - Free charting platform with live stock market quotes, no ads, all features included. Where to Find Free Stock Charts · TradingView · Yahoo Finance · dealermobil.site · Google Finance · dealermobil.site · MarketWatch · dealermobil.site · dealermobil.site In this post, we are going to show you a list of the 5 best free stock chart websites for For stock traders, a good stock charting software is a. Market Gear's charting capabilities allow you to analyze customizable indicators, view your trades, draw permanent trendlines, review past trades, and select. In this article, we will walk you through the best platforms and websites for accessing top-notch, free stock charts. Interactive financial charts for analysis and generating trading ideas on TradingView! Our advanced charts offer a dynamic features like click & drag interaction, event indicators, and right-click interactivity. Our research shows TradingView is the best free stock charting analysis software, with indicators and charts for stocks, Forex, commodities, and ETFs. Moomoo boasts 38 drawing tools to help you identify trade signals faster, even using sophisticated charts The moomoo app is an online trading platform offered. ProRealTime Web - Free charting platform with live stock market quotes, no ads, all features included. Where to Find Free Stock Charts · TradingView · Yahoo Finance · dealermobil.site · Google Finance · dealermobil.site · MarketWatch · dealermobil.site · dealermobil.site In this post, we are going to show you a list of the 5 best free stock chart websites for For stock traders, a good stock charting software is a. Market Gear's charting capabilities allow you to analyze customizable indicators, view your trades, draw permanent trendlines, review past trades, and select.

You're able to create custom online futures charts through NinjaTrader, which unlocks a world of possibilities for your trades. Not only that, but NinjaTrader. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Get a Daily List of Stocks Starting New Trends · Upload Your Stocks to Quickly See and Track Signals (coming soon) · Easy to Understand AI Stock Signals · Analysis. StockChart is a simple app which provides one click link to your favorite stock charts on dealermobil.site with detailed settings such as overlay, indicator. Several websites offer the analysis of the best free stock charts. Some popular options include FusionCharts, dealermobil.site, and Yahoo Finance. Each platform. Dozens of sites offer free stock charting but Stock Rover breaks from the pack by offering chart controls that are easy to use and far more capable. Technical indicators are created by visitors and the web based Ai program. Benefits of this web site include free real time level 2 stock quotes and. Stock Chart is well suited for visualizing stock, financial, and other time-based data. Based on the super-fast amCharts 5 engine it delivers a new level of. Many popular trading sites come with built-in charting tools that allow you to automatically include technical indicators and moving averages. Who Should Use This: StockCharts is great for traders who want to analyze chart patterns, volume, and price action. You can't paper-trade with this site, but. The best free stock charts are on TradingView. Other free charting websites include dealermobil.site, FINVIZ, Stock Rover and Yahoo Finance. BigCharts is the world's leading and most advanced investment charting and research site. dealermobil.site's real-time charting tool is a robust, technically advanced resource that is easy to use, so it's intuitive enough for beginners but also. TradingView. TradingView provides free real-time stock charts that are visually appealing and can be customized with hundreds of technical indicators. 1. Tradingview If you value a stock chart software with great technical and fundamental analysis, then we recommend Tradingview. A fully functional trading simulator that gives you access to all stock & option strategies. You can practice limit orders, bracket orders with profit targets. We provide tools, like free live stock charts, and resources to help you understand how to invest your money and propel your accounting or finance career. Premium Stock Charts & Trading Tools. Improve your trading performance with insights from proprietary indicators and powerful stock screens. I've listed 3 great stock charting tools that offer free versions. These tools are great for when you're just learning to trade, or as a supplement to other. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more.

Indian Rupee Usd

1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug 1 INR = USD Aug 28, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Convert Rupees to Dollars otherwise known as INR to USD. Live conversions at of August Table of 1 US Dollar to Indian Rupee Exchange Rate ; Tuesday 27 August , 1 USD = INR, , , USD INR rate for 27/08/ ; Monday 26 August. Find the latest USD/INR (INR=X) stock quote, history, news and other vital information to help you with your stock trading and investing. Convert USD to INR with the Wise Currency Converter. Analyze historical Conversion rates Indian Rupee / US Dollar. 1 INR, USD. 5 INR, Convert USD to INR with BookMyForex currency calculator. Get Live US Dollar to Indian Rupee rate & lowest USD to INR conversion charges. Contact us for best. Today's current currency conversion rate of Dollar to INR is 1 USD = INR. So if you have INR then divide / = dollars. Thus, you will. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. USD to INR Currency (USD to INR) Exchange Rate - Last 10 Days ; Aug ; Aug ; Aug ; Aug ; Aug 1 INR = USD Aug 28, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Convert Rupees to Dollars otherwise known as INR to USD. Live conversions at of August Table of 1 US Dollar to Indian Rupee Exchange Rate ; Tuesday 27 August , 1 USD = INR, , , USD INR rate for 27/08/ ; Monday 26 August. Find the latest USD/INR (INR=X) stock quote, history, news and other vital information to help you with your stock trading and investing. Convert USD to INR with the Wise Currency Converter. Analyze historical Conversion rates Indian Rupee / US Dollar. 1 INR, USD. 5 INR, Convert USD to INR with BookMyForex currency calculator. Get Live US Dollar to Indian Rupee rate & lowest USD to INR conversion charges. Contact us for best. Today's current currency conversion rate of Dollar to INR is 1 USD = INR. So if you have INR then divide / = dollars. Thus, you will.

Download Our Currency Converter App ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 20 INR, USD.

Check live exchange rates for 1 USD to INR with our USD to INR chart. Exchange US dollars to Indian rupees at a great exchange rate with OFX. USD to INR. Currencies Pairs ; USD/CHF, , ; USD/JPY, , ; USD/MXN, , ; USD/INR, , Indian Rupee to US Dollar conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject. Indian Rupee - values, historical data, forecasts and news - updated on Alerts. The Indian rupee depreciated toward its record low of 84 per USD in. Get US Dollar/Indian Rupee FX Spot Rate (INR=:Exchange) real-time stock quotes, news, price and financial information from CNBC. The US Dollar to Indian Rupee exchange rate fluctuates every day. To keep the conversion of USD to INR convenient as per the live USD exchange rates, you can. Convert INR to USD with the Western Union currency dealermobil.site Indian Rupee and your receiver will get US Dollar in minutes. Comprehensive information about the USD INR (US Dollar vs. Indian Rupee). You will find more information by going to one of the sections on this page. USD to INR | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Indian Rupee. US Dollar to Indian Rupee Exchange Rate is at a current level of , up from the previous market day and up from one year ago. FX: USD – INR Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. Indian Rupee/USD Futures - Quotes ; AUG SIRQ4. (%). ; SEP SIRU4. (%). Current exchange rate INDIAN RUPEE (INR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Updated spot exchange rate of INDIAN RUPEE (INR) against the US dollar index. Find currency & selling price and other forex information. INR/USD Quotes ; Real-time Currencies. 28/ , ; CME. 28/ , ; CME. 28/ , Graph and download economic data for Indian Rupees to U.S. Dollar Spot Exchange Rate (EXINUS) from Jan to Jul about India, exchange rate. Convert INR to USD with BookMyForex currency calculator. Get Live Indian Rupee to US Dollar rate & lowest INR to USD conversion charges. USD to INR Converter USD INR Buy, Sell or Transfer US Dollar (USD) in India at the best exchange rates Currency Rate Today US Dollar (USD) to Indian Rupee (INR). The current rate of USDINR is INR — it has increased by % in the past 24 hours. See more of USDINR rate dynamics on the detailed chart. Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates.

Is Apple Card Good

Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit card can do. Apply in as little. Apple FCU credit cards offer a variety of benefits, including points, cash back, and low rates. No Balance Transfer Fee. Apply for an Apple FCU credit card. Apple Card eliminates fees, provides innovative tools for managing your spending and reducing your interest, helps you build your savings, and as an Apple. Apple Card is a better kind of credit card. And with Apple Card Monthly Installments, you can pay for a new iPhone with interest-free payments. Apple Card offers up to 3% Daily Cash back on purchases with no fees. Apply with no impact to your credit score to see if you're approved. Terms apply. The Apple Credit Card requires good or excellent credit for approval. This means that you should have a credit score of at least , to. Mastercard Benefits for Apple Card Customers · Zero Liability Protection · Mastercard ID Theft Protection · ShopRunner · Mastercard Travel & Lifestyle Services. Apple Card offers a zero-fee structure, quick cash-back rewards and a sleek design that fits in well with other Apple products. They can also connect their card with and pay for fuel through the Exxon Mobil Rewards+™ app. Apple Card with. Apple Pay is a contactless payment method that. Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit card can do. Apply in as little. Apple FCU credit cards offer a variety of benefits, including points, cash back, and low rates. No Balance Transfer Fee. Apply for an Apple FCU credit card. Apple Card eliminates fees, provides innovative tools for managing your spending and reducing your interest, helps you build your savings, and as an Apple. Apple Card is a better kind of credit card. And with Apple Card Monthly Installments, you can pay for a new iPhone with interest-free payments. Apple Card offers up to 3% Daily Cash back on purchases with no fees. Apply with no impact to your credit score to see if you're approved. Terms apply. The Apple Credit Card requires good or excellent credit for approval. This means that you should have a credit score of at least , to. Mastercard Benefits for Apple Card Customers · Zero Liability Protection · Mastercard ID Theft Protection · ShopRunner · Mastercard Travel & Lifestyle Services. Apple Card offers a zero-fee structure, quick cash-back rewards and a sleek design that fits in well with other Apple products. They can also connect their card with and pay for fuel through the Exxon Mobil Rewards+™ app. Apple Card with. Apple Pay is a contactless payment method that.

The Apple Credit Card can be worth it if you're an Apple devotee who regularly buys products directly from Apple or retailers included on the card's list of. Right now the Apple Card is a decent credit card with relatively low interest rates and modest cash back when you use ApplePay. The potential. The Apple High-Yield Savings Account has an attractive APY of %; almost ten times the current national average savings rate of % (as of August 19, It's 2% cash back and makes for a good "catch all" card if you are spending outside a category where you can earn more with a different card. The best Apple Card benefits are zero liability protection and Mastercard ID theft protection. These perks are certainly good to have, though it's important to. Apple Cash is more secure than a traditional debit card. For starters, it uses Face ID or Touch ID to authenticate your transactions — to make sure you're, well. Apple Card Family lets you co-own your Apple Card account with one member of your Family Sharing group. You can share your credit line with a co-owner. You get 3% Daily Cash back, all up front. Simply choose Apple Card Monthly Installments as your payment option when you make your purchase at an Apple Store, in. Apple Card holders earn 3% cash back on Apple purchases and Apple Pay purchases made at select businesses, 2% back on purchases made using Apple Pay and 1%. To complete this step, regularly make on-time payments on your loans and lines of credit to keep your accounts in good standing. This excludes medical debt. It. Apple Card is STRONGLY NOT RECOMMENDED based on 16 reviews. Find out why and discover its pros & cons. Unlike many credit cards in the industry, Apple promises to make it easier for you to pay down your credit card balance, so it is not carrying any fees —. It very well could be — even if you're not obsessed with Apple products — but it depends on your situation. You might find that the Apple Card offers value as. Apple Card holders earn 3% cash back on Apple purchases and Apple Pay purchases made at select businesses, 2% back on purchases made using Apple Pay and 1%. The Apple Card best suits beginners and offers a simple rewards rate across all purchases. It could fit you if you make many purchases with Apple Pay or the . Individuals with excellent credit scores could qualify for an APR on the low end of the % to %, which is a better rate than the national average APR. While the Apple Card is a good card for Apple product users, it fares poorly compared to the best cash-back cards; and other banks, such as Bask Bank or Varo. Apple Card or Apple Pay Later? Which one should I use? The Apple Card is, admittedly, a credit card. Although there are no fees, you must pay interest on the. Aside from the cash back program and lack of fees, most of the ballyhoo around the Apple Card focuses on the design of its app. The interface does look pretty. This doesn't help with your financial goals of getting a Credit Card, but damn, the Apple Card is one beautiful piece of metal! It is clean.

Geico Drive Easy Review

DriveEasy offers discounts on car insurance premiums by monitoring safe driving habits through the GEICO mobile app. Join the ,+ teen drivers that have. Online or mobile app, it makes managing my payments and policy easy customer serv Read full review. About GEICO auto insurance. GEICO is an insurance. DriveEasy is GEICO's safe-driving program that puts you in control of your rate by rewarding you with savings based on your driving behavior. Using the sensors. Final Verdict: Review of Geico As one of the largest insurance providers in the country, Geico has low rates for most drivers. However, high-risk drivers will. drive to destroy and add injury to what we were already experiencing. I dealermobil.site More Info. Hours. Geico Reviews in Other Languages. Spanish. 1 Review. Consequently, our Underwriting Department sent a letter requesting additional information to proceed with our review. Afraid to drive now. I do not. Life is full of lane changes. Some expected. Some not as much. No problem, because the GEICO Mobile app is here to lend a hand if you ever need a quote. Join the people who've already reviewed GEICO. Your experience can help Write a review. Company activitySee all. Unclaimed profile. No history of. Their app is user-friendly and you can do almost everything you need to do on it. My husband totaled his car a few months ago. I was astounded at how easy the. DriveEasy offers discounts on car insurance premiums by monitoring safe driving habits through the GEICO mobile app. Join the ,+ teen drivers that have. Online or mobile app, it makes managing my payments and policy easy customer serv Read full review. About GEICO auto insurance. GEICO is an insurance. DriveEasy is GEICO's safe-driving program that puts you in control of your rate by rewarding you with savings based on your driving behavior. Using the sensors. Final Verdict: Review of Geico As one of the largest insurance providers in the country, Geico has low rates for most drivers. However, high-risk drivers will. drive to destroy and add injury to what we were already experiencing. I dealermobil.site More Info. Hours. Geico Reviews in Other Languages. Spanish. 1 Review. Consequently, our Underwriting Department sent a letter requesting additional information to proceed with our review. Afraid to drive now. I do not. Life is full of lane changes. Some expected. Some not as much. No problem, because the GEICO Mobile app is here to lend a hand if you ever need a quote. Join the people who've already reviewed GEICO. Your experience can help Write a review. Company activitySee all. Unclaimed profile. No history of. Their app is user-friendly and you can do almost everything you need to do on it. My husband totaled his car a few months ago. I was astounded at how easy the.

○ Geico: DriveEasy ○ Nationwide: SmartRide ○ Progressive: Snapshot The team doesn't keep samples, gifts, or loans of products or services we review. Total scam. Beware. They use drive easy app to bat and switch. icon. Amanda White Insuranker. Policy Type: Auto Insurance. It provides standard coverage policies and perks for everyday drivers and operates nationwide. Geico also extends its insurance offerings beyond auto insurance. Easy to open a new policy, according to customer feedback. Cons: Average annual rate is higher than the national average. Geico Car Insurance Review. Geico is. Geico's DriveEasy program has received various complaints from users for reasons such as technical problems, issues with points and rewards, and lack of. My insurance saving is $ for the next 3 years! Esther C. User-friendly and easy. The course was extremely user friendly and it was extremely informative and. If you're a safe driver, DriveEasy could help you save up to 25% on your premium, including the initial sign-up discount of 15%. The app automatically tracks. Simply get on the road and drive—it's that easy. SAVE. You can check For more information about Snapshot, please review our Snapshot Privacy Statement and. The GEICO DriveEasy program uses your mobile phone to measure your driving. It looks at things like how fast you take corners, how hard you brake, and if you. The Geico DriveEasy Program can reduce your monthly rates by up to 25% for safe driving, but risky habits may increase your premiums. Geico DriveEasy also. review your policy and contact a customer service agent to The easiest way to take advantage of this discount is through an online defensive driving. We've added some reminders in the app to let you know if someone on your policy still needs to register. + If this is your first time downloading DriveEasy. They were very helpful. Since the lady admitted fault from the start, geico sent me reimbursement for my deductible before they even collected the payment from. The telematics options from both Progressive and GEICO could offer savings for safe drivers. However, keep in mind that depending on your driving habits, you. My insurance saving is $ for the next 3 years! Esther C. User-friendly and easy. The course was extremely user friendly and it was extremely informative and. DriveEasy: Geico offers up to 10% savings for safe drivers who agree to have their driving behaviors tracked. To participate in the DriveEasy program, download. Geico raised my auto insurance payment more than 40% between and , in two steps. I drive less than 5k miles a year, no speeding tickets, no accidents. Using sensors in your phone, DriveEasy automatically logs your driving behaviors — like how fast and far you drive, how hard you brake and how often you use. Convenient Online Services: GEICO has a strong online presence, providing easy-to-use digital tools for policy management, claims filing, and.